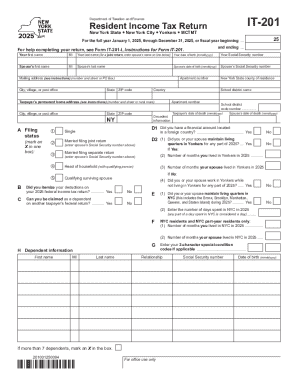

NY DTF IT-201 2010 free printable template

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

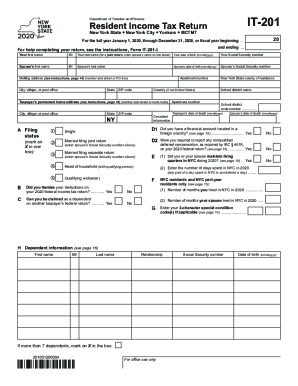

About NY DTF IT previous version

What is NY DTF IT-201?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about NY DTF IT-201

What should I do if I realize I made a mistake on my it 201 after filing?

If you discover an error after submitting your it 201, you can file an amended return using Form IT-201-X. This form is specifically designed to correct mistakes in your original return. It's important to submit the amended return as soon as possible to avoid any potential penalties or interest.

How can I check the status of my it 201 filing?

To verify the status of your filed it 201, you can visit the official tax authority's website and use their online tracking tool. You'll typically need your Social Security number and the amount of your refund or payment. If you filed electronically and encounter issues, be aware of common e-file rejection codes that may require resolution.

What are the data security measures for electronically filed it 201 forms?

When e-filing your it 201, ensure you're using secure software that complies with privacy standards. Look for platforms that provide encryption and safeguard your personal information. Record retention is also crucial; keep copies of your e-filed forms and related documentation for at least three years.

Can I file an it 201 for someone else?

Yes, you can file an it 201 on behalf of someone else, provided you are authorized to do so. This might involve obtaining a Power of Attorney (POA) if you're acting as their representative. Ensure that you have all necessary documentation and accurate information to complete the filing correctly.

What common errors should I avoid when submitting my it 201?

Common mistakes when filing the it 201 include incorrect Social Security numbers, mismatched income figures, and failing to include all necessary income sources. Double-check your entries against your tax documents and ensure all relevant information is present before submission to prevent delays or rejections.

See what our users say